Snapchat shares new insights into the potential for brands to connect with audiences in the app

A few years back, when Meta copied Snapchat’s Stories format and made it into its own on Instagram, it seemed like Snapchat was going to struggle to remain relevant in the evolving social media landscape.

But Snap stuck to its guns. It doubled down on its key use case, in connecting friends, and it continued to develop its still industry-leading AR tools and features, which has enabled Snapchat to both maintain relevance, while also building the foundations for a stronger future.

And now, that connective capacity has it well-placed to boost its appeal to ad partners, with its focus on joy and positive engagement facilitating new opportunities.

Snapchatters come to the app and actively engage, sharing as much content as they receive. This spirit of sharing and connection creates a natural home for brands to enter the conversation, providing an opportunity to enter directly into a Snapchatters’ inner circle and begin to establish a relationship with them. And with Snapchatters 30% more likely to make a purchase on social media compared to non-Snapchatters, it’s more important than ever for your brand to be present on Snapchat.

Underlining this, Snap has shared some new insights into how users feel when using the app, and where brands can fit into the process.

First off, Snap says that some 95% of Snapchatters agree that the app helps them to stay connected with friends and family, while 87% of Snapchatters agree that they can be fully themselves in the app.

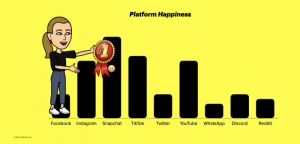

It’s little surprise, then, to see that Snapchat has been ranked as the happiest platform that focus on positive interactions reaches over to brands as well, with 1 in 2 Snapchat users agreeing that they often enjoy seeing brands in the app, while 82% of Snapchatters actively engage with brands. And its evolving AR tools play a part in this too, with Snapchatters that use branded AR elements increasingly likely to make a big purchase – like a laptop, a smartphone, or even a car.

Snap showcased its latest AR tools for commerce, and how its AR ad options are evolving, and based on these insights, they could well provide major benefits to businesses looking to connect with the Snap audience.

Though Snap remains primarily a younger audience app. Users aged between 18 and 24 make up 39% of Snap’s total audience, while Snap now claims to reach more than 75% of 13-34 year olds in over 20 countries.

But over time, inevitably, Snap’s audience is getting older, and if the platform can evolve with its user needs, that could see it well-placed to become an even bigger advertising consideration over time, while its AR development could also ensure that Snap is well-placed to capitalize on its opportunities.

These figures further underline its potential here, and it may well be worth giving Snap some more consideration for your future ad campaigns.

Related Posts

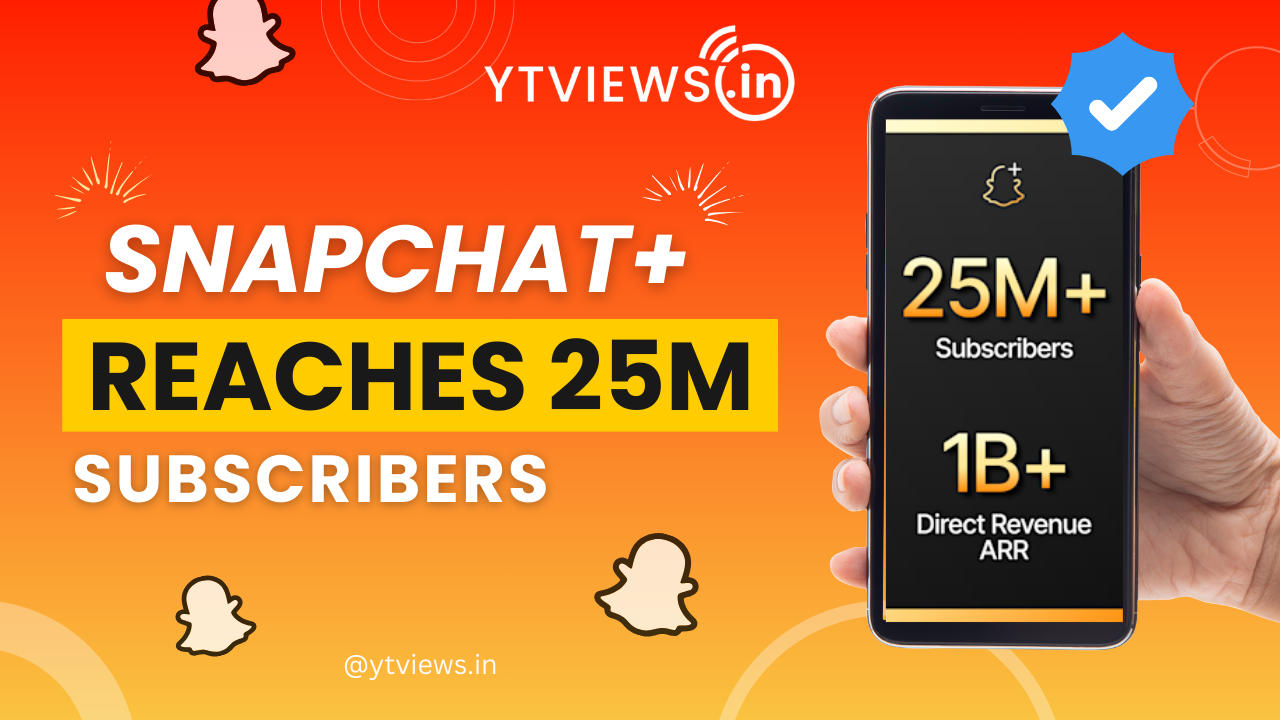

Snapchat+ Hits 25M Subscribers, $1B Milestone

Snapchat Introduces Paid Subscriptions for Creators

Snapchat Family Center: Safer Social Media for Teens

How Snapchat Is Changing the Way Brands Start Conversations

Snapchat Just Turned Chat Into a Search Engine