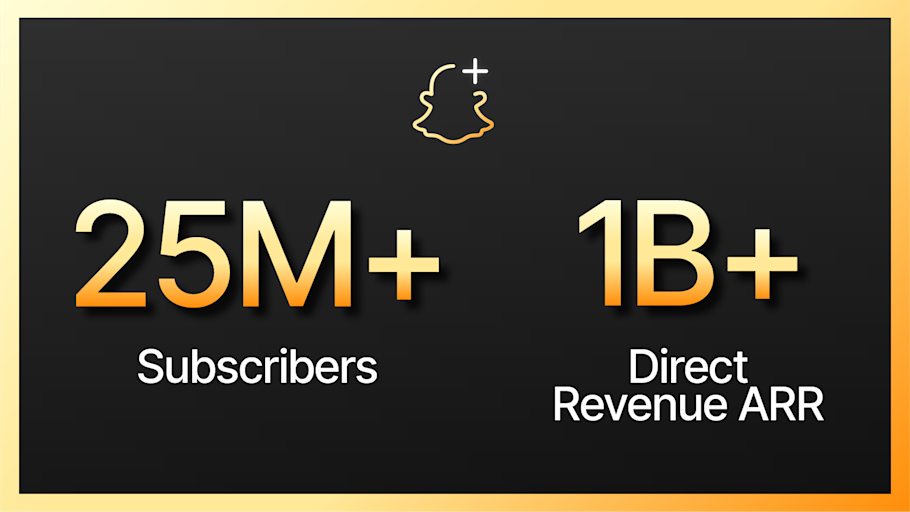

Snapchat+ Hits 25M Subscribers, $1B Milestone

When Snap Inc. introduced Snapchat+ in late 2022, it didn’t feel revolutionary. It felt experimental. A few exclusive features. Early access tools. Some customization perks.

Fast forward to 2026, and that “experiment” now has over 25 million subscribers, contributing more than $1 billion per year in non-advertising revenue. That’s not pocket change. That’s a serious business shift.

In a digital landscape where most platforms depend heavily on advertising revenue, Snapchat quietly built a second engine.

Why Snapchat+ Is Growing So Fast

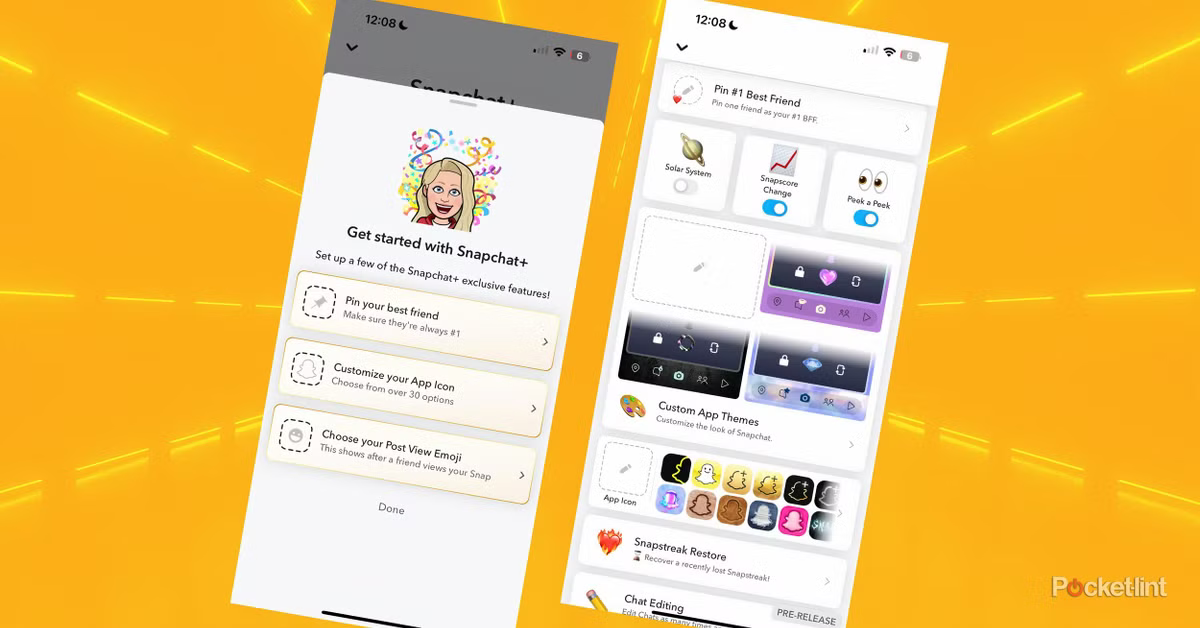

Here’s the difference: Snapchat+ doesn’t try to reinvent the app. It enhances it.

Subscribers get access to advanced AR lenses, priority features, customization tools, and expanded storage options. The value feels practical. It feels built for people who already love using Snapchat daily. Even programs like Meta Verified operate differently, leaning more toward identity confirmation and visibility perks. Snapchat’s model feels more product-driven.

That clarity matters. People pay when they see direct value.

A Smart Move Amid Slowing User Growth

Snapchat’s growth in key regions like the U.S. and Europe has leveled out. The platform remains strong with younger users, but expanding beyond that core audience isn’t easy.

That reality forces a simple question: if you can’t grow users rapidly, how do you grow revenue?Snap’s answer is diversification. Alongside advertising tools like Sponsored Snaps, the company is pushing into subscriptions and hardware. Its upcoming AR glasses, Snap Specs, aim to keep it competitive in the augmented reality space — a market where giants like Apple Inc. and Meta are investing heavily.

But hardware takes time. Subscriptions generate steady, recurring income now.

Conclusion

Snapchat+ crossing 25 million subscribers isn’t just a breaking news . It’s just a showcase that users are willing to pay if they are provided with better experiences.

In a crowded social media economy, Snap chose to deepen loyalty instead of chasing endless reach. And that strategy is turning into a billion-dollar advantage.

Related Posts

Snapchat Introduces Paid Subscriptions for Creators

Snapchat Family Center: Safer Social Media for Teens

How Snapchat Is Changing the Way Brands Start Conversations

Snapchat Just Turned Chat Into a Search Engine

Smart Brands Share Reels Beyond Instagram